Introduction to CASS eLearning

Overview

This interactive and engaging eLearning module provides a comprehensive introduction to the FCA’s Client Money and Assets (CASS) rules.

It explains why some firms hold client money and assets, and why this aspect of regulation has become such a focus for the FCA, including examples of action taken by the regulator when firms have breached the rules. It provides an overview of some of the specific obligations on firms that hold client money or assets, including the need for strict segregation of client and firm money and assets, as well as the rules relating to documentation and reconciliation.

Finally, it explores the specific governance requirements the FCA places on CASS firms.

This module and the end assessment can be tailored to incorporate client-specific content.

Course Details

- Why do Firms Hold Client Money or Assets?

- When Things Go Wrong

- The CASS Rules

- Segregation

- Reconciliations

- Registration of Assets

- Governance

- Assessment

Delivery

Our interactive learning is delivered online, so all you need is an internet-connected device – we’ll do the rest.

We handle every part of the set-up process, from customising your individual Learning Management System (LMS), loading staff data, setting up a deployment and reminder schedule and reporting on progress.

In addition, administrators can also have access to all of these tools too, giving you the flexibility to be involved as much or as little as you prefer.

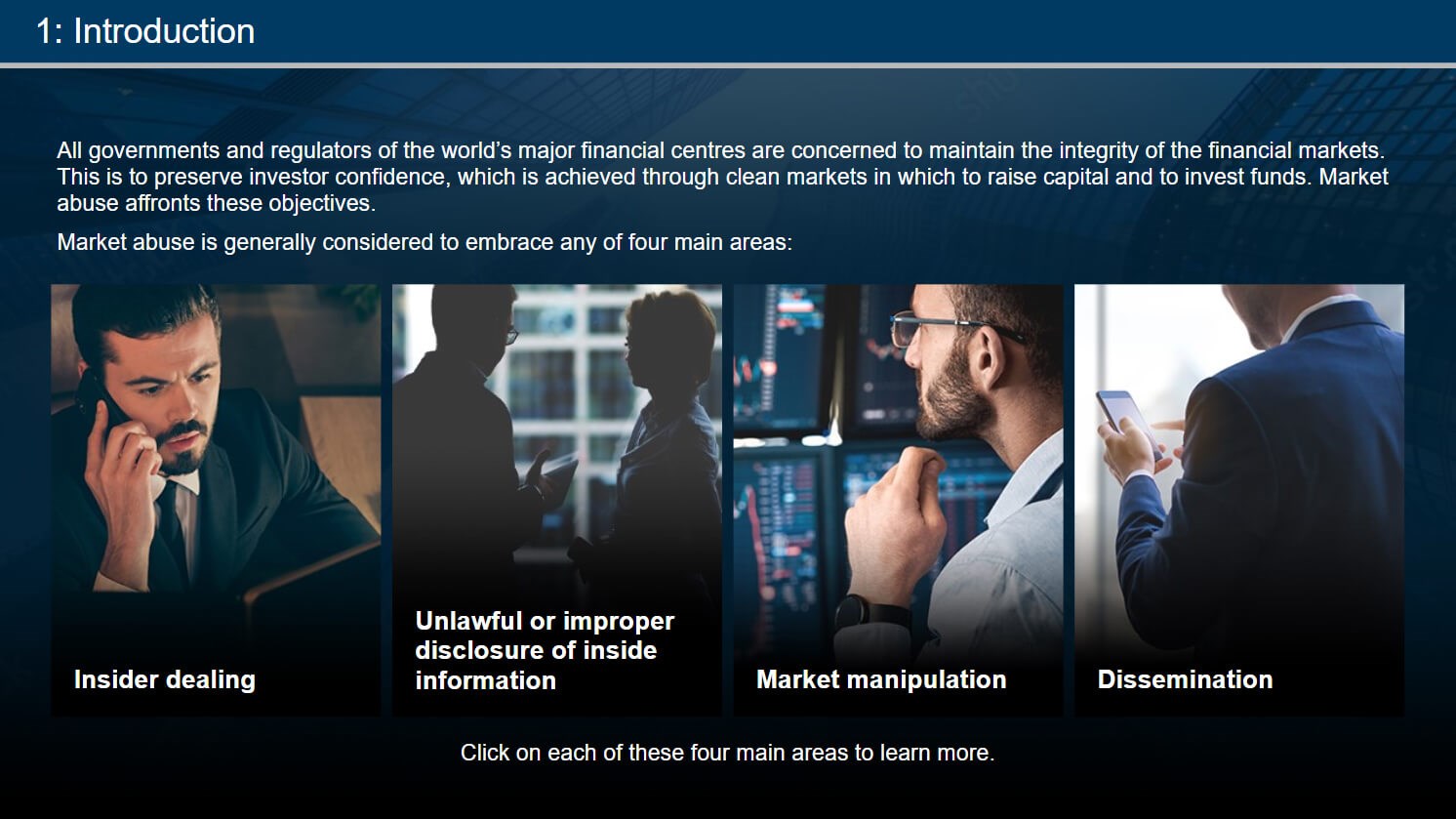

eLearning Previews

See examples taken from a range of our eLearning courses in the gallery below.